Wondering if building business credit is really worth the effort?

If you've been following our weekly emails, you’ll know there’s more to business credit that most people talk about on tiktok or social media. For instance, did you know that a whopping 77% of business owners use their personal savings and credit to fund their businesses?

The Problem With Using Personal Credit to Fund Your Business

However, the average American has less than $1,000 in their savings account and around $29,000 in total credit. This is a significant reason why many small businesses struggle to have the working capital they need.

That's where a business credit building program like Corporate Credit Secrets comes in. But before we dive into that, let me share a little story about an epiphany I (Zachary) had when discussing my not-so-great credit score with Jon and Carlton.

"STOP trying to keep your life AND business afloat with the small limits of your personal credit - it wasn't meant to be used like that!" Jon said.

Are You Making This Key Credit Mistake?

"A big reason your credit score is low is because your credit utilization is high. Since a good chunk of your credit is going toward business expenses, you can quickly boost your score by using corporate credit wisely."

"That makes a lot of sense," I replied.

If you're anything like me, you might be relying on credit cards. However, after maxing out my personal credit and talking to HUNDREDS of business owners over the years, I've come to realize how much money it takes to run a business. And when you max out your personal credit, what do you do next?

That's why you want to protect your personal credit at all costs!

With good credit, you can always get approved for more. But once you've wrecked your personal credit, your only option is to repair it or, worst-case scenario, declare bankruptcy – and who wants to do that, right?

But what if there was a way to create an entirely NEW credit profile? One that allows you to have credit limits 10 times higher and carry high balances without harming your personal credit? What if it also let you secure certain lines of credit without a personal guarantee? So, if the business doesn't work out, your personal funds and assets remain safe.

How Successful Entrepreneurs Are Going Straight to the Money

Ever wondered how entrepreneurs like Robert Kiyosaki, Noelle Randell, Codie Sanchez, and House Flipper Jerry Norton can start and grow their businesses SUPER FAST without maxing out their personal credit or risking their own money or assets? It's because they understand business credit building and how to use Corporate Credit to their advantage. They're going STRAIGHT TO THE MONEY!

That's the epiphany Jon and Carlton shared with me. When it comes to business credit building, they've devised a strategy to go straight to the money.

Building business credit with a program like Corporate Credit Secrets makes all of this possible & more!

How the Corporate Credit Secrets Program Helped Me

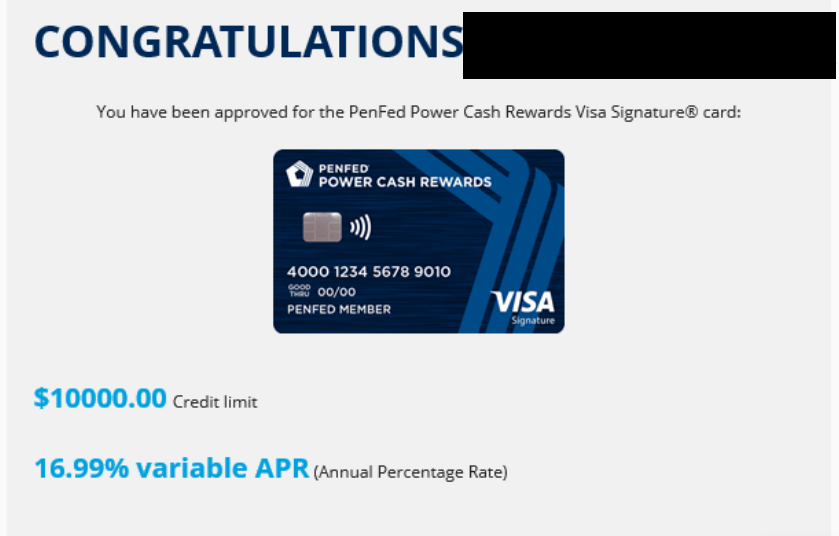

They guided me through the process of landing my first Corporate Credit card with an $10,000 limit in just 30 days. And they showed me how to use the money from the banks to get even more credit right off the bat.

I was excited and a little nervous because I had never received that much money without a solid business that had been making money (my business was registered just weeks before and had no experience or credibility). But I though to myself, "At this point, what have I got to lose?"

I had no idea that any of this was even possible at the time, and it truly blew my mind.

As I learned, there are numerous benefits to building strong corporate credit. In tomorrow's post, I'll reveal all the hidden benefits I discovered, so stay tuned for that.

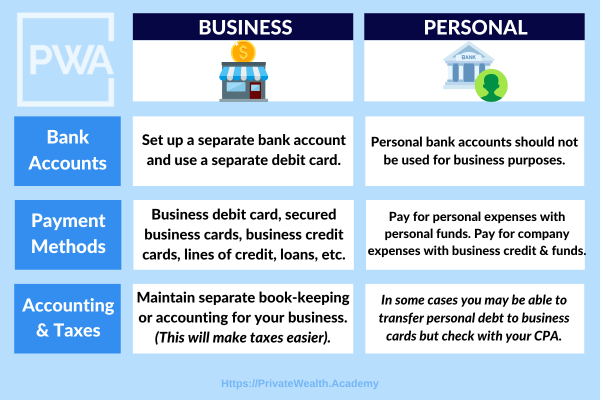

Business Credit vs. Personal Credit

Sure, you can accumulate substantial personal credit over many years with good habits, patience, and diligence. But businesses always get approved for MUCH LARGER credit limits because lenders know they need more money (compared to an individual).

Are You Beginning to See What Business Credit Can Do?

Corporate Credit Secrets is now open to the public. With our proven method, you can build high-limit corporate credit in the least amount of time possible. This approach can help you secure tens to hundreds of thousands in credit, and you can repeat it as many times as you want.

If you're tired of struggling with cash, getting denied credit, or worrying about your business's survival, Corporate Credit Secrets might be the solution for you. Explore how it can help you out and see you on the inside!

And if you missed it, you can still watch the NEW Corporate Credit Workshop here. It explains the power of corporate credit and how our proven system offers a different approach.

Want Help Getting Approved for High Limit Business Credit?

We have so much more to share with you to help you get approved for the money you need. So, if you want help in establishing business credit to grow your company faster, and want to get approved for higher credit limits in less time, consider joining our Corporate Credit Secrets Program.

We've recently updated the entire program and you're going to LOVE what we have to show you!

What Corporate Credit Secrets Will Help You Accomplish

What You'll Learn:

Not only will you learn how to establish a new company, you'll discover the quickest way to create your corporate credit profile, what to do if you're in a high-risk industry, important tips when opening your business bank accounts, the best lenders to get credit from, how to choose the best types of funding for your business, what to do if you have little to no time-in-business or revenue and SO MUCH MORE! We'll even share a few ways to quickly boost your personal credit score so you can get access to the MOST MONEY possible!

By following the strategies and techniques outlined in Corporate Credit Secrets, you're not just building credit; you're opening the door to new opportunities. Opportunities to grow, expand, and thrive in a competitive business environment. You're setting your company up for financial stability and resilience, even during challenging times.

The Opportunities You'll Have:

Remember, your business credit score isn't just a number; it's a reflection of your company's overall financial health and trustworthiness. With a strong credit profile, you'll have access to the money you need, along with better terms and rates, and the ability to make strategic decisions for your company.

But don't wait. Because right now students with BRAND NEW companies are getting approved for $50,000-100,000 in no-doc business credit per lender! (We can help you do the same!)

We promise you'll be able to secure $50,000 or more in 6 months or less!

Does 6 months sound too long?

*Don't worry you'll probably secure business credit MUCH FASTER than 6 months but we like to under-promise and over deliver since some students are starting with no business whatsoever. If your business is already up and running this process will go MUCH FASTER for you and you can probably obtain $50,000+ in just a few weeks or even days!

One student recently got approved for over $100K in just 18 DAYS! Isn't that awesome?

Need more than $100K?

We've got you covered! This isn't just plain old vendor credit you heard about on social media. Not only will we show you how to find a virtually unlimited supply of lenders - we'll give you our business credit fast-track framework that will show you how your company can get approved for over $1,000,000 (over a million dollars) in no-doc unsecured business credit! Isn't that incredible?

If you're ready to take your business to new heights, then it's time to establish strong business credit with the help of Corporate Credit Secrets.

The Business Credit Guarantee You Won't Find Anywhere Else

Despite the "credit crunch" businesses (even brand new startups) are STILL getting approved for $50K, $100K, $150K every day! Aren't you ready to be one of them?

Imagine having access to over $50K-100K in credit within just a few weeks or months - it's not a dream, it's a guarantee. If you're not able to secure at least $50K within 12 months, we'll refund every penny!

You just need to know what lenders are looking for and the right steps to take.

With Corporate Credit Secrets, you can supercharge your business growth, expand your operations, and take your entrepreneurial journey to the next level. Don't miss out on the financial stability and competitive advantages that strong corporate and business credit can bring…

Corporate Credit Secrets is a step-by-step guide will show you exactly how to get approved for the best business credit offers to improve your company's cash flow and success. If your company needs more working capital - why wait? The methods we teach will work even in tight lending environments so there's no better time to learn how to get all the money your business needs.