Are you wondering how much business credit your company can get approved for?

Have you faced difficulties in getting the credit amounts you need in the past?

Don't worry; you're not alone in this. It can be tough to secure a significant high limit credit, especially if you're a new business with minimal or no revenue.

If you get our weekly emails, you might remember that there are a few steps to getting business credit. First, you need to prepare your company in a way that makes banks willing to lend to you. This means making your company more appealing to lenders (we’ll show you how to do this inside Corporate Credit Secrets program).

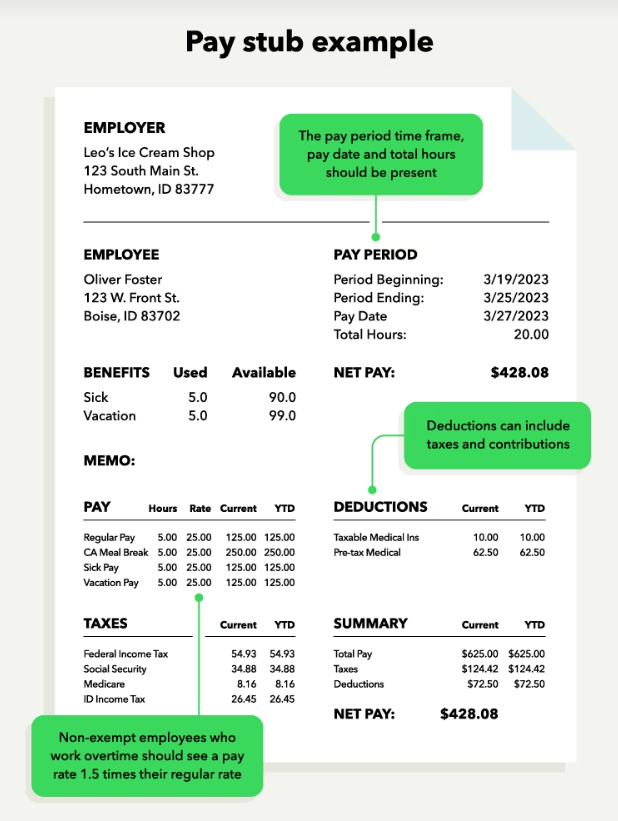

Once your company has a few tradelines reporting, you'll get established credit scores which can help your company get approved for credit with just your EIN. The next step is to prepare any proof of income or revenue that you may have. The easiest way to do this is to create pay stubs using a service like ADP, Zoho, or Quickbooks. This is the key to approvals. Having even 2-3 months of pay stubs can get your company approved with most lenders.

Next you want to set your business credit goals and figure out which lenders to approach based on the credit products you're seeking. The "perfect lender" varies based on your business and your goals. In our program, we provide more details about this, but for small businesses, local community banks and credit unions are often your best options. They tend to be more lenient and have a personal approach to qualifying for credit.

How Much Can I Be Approved for with a Single Inquiry?

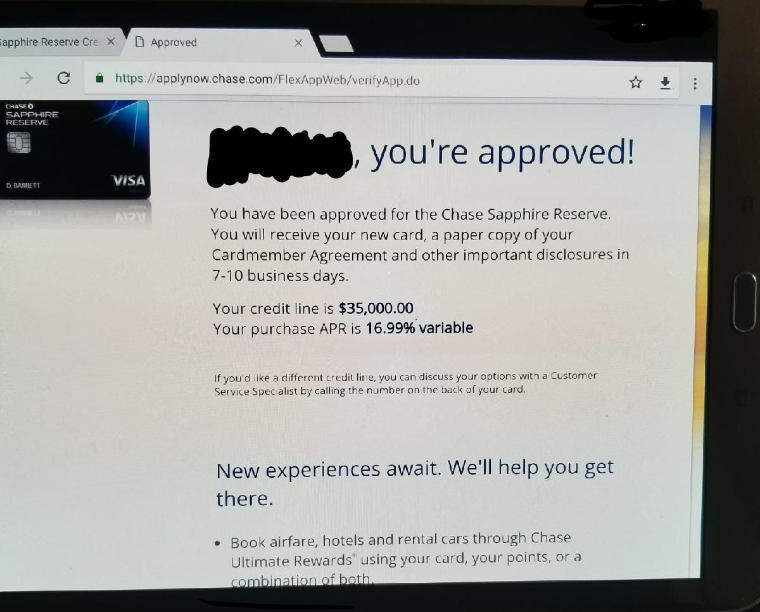

We've seen approvals for as little as $500 and as high as $150,000 or more from a single credit inquiry. However, the amount you can secure depends on your specific business and previous credit.

How Much Will My Company Be Able to Secure?

To get an idea of how much business credit YOUR company can obtain, look at your business's revenue and sales. Lenders usually approve a credit limit that's 5-20% of your company's annual revenue for credit offers like credit cards or lines of credit. Loans are an exception due to higher interest rates and longer repayment terms.

If you're just starting and have little to no income, look at how much personal credit you already have. Banks often use your current credit limits; especially when it comes to business credit cards and you don’t have any revenue to show. Generally, you can secure up to $50,000 to $75,000 for business credit cards from a single inquiry without needing extensive documentation, which is pretty good! In some rare cases, you might even secure up to $100,000. What's more common (and usually easier) is to obtain multiple business credit cards with lower limits, typically ranging from $5,000 to $25,000 each.

The good news is that this is just the beginning...

If your company has been around for a while (more than 2 years) and consistently generates sales and revenue, you can potentially access even higher amounts of credit, such as $100,000, $200,000, or even $500,000 or more. There is no limit to how much credit you can secure for your company. Just keep in mind that as you request more funding, you'll usually need to provide more documentation.

Want Help Getting Approved for High Limit Business Credit?

We have so much more to share with you to help you get approved for the money you need. So, if you want help in establishing business credit to grow your company faster, and want to get approved for higher credit limits in less time, consider joining our Corporate Credit Secrets Program.

We've recently updated the entire program and you're going to LOVE what we have to show you!

What Corporate Credit Secrets Will Help You Accomplish

What You'll Learn:

Not only will you learn how to establish a new company, you'll discover the quickest way to create your corporate credit profile, what to do if you're in a high-risk industry, important tips when opening your business bank accounts, the best lenders to get credit from, how to choose the best types of funding for your business, what to do if you have little to no time-in-business or revenue and SO MUCH MORE! We'll even share a few ways to quickly boost your personal credit score so you can get access to the MOST MONEY possible!

By following the strategies and techniques outlined in Corporate Credit Secrets, you're not just building credit; you're opening the door to new opportunities. Opportunities to grow, expand, and thrive in a competitive business environment. You're setting your company up for financial stability and resilience, even during challenging times.

The Opportunities You'll Have:

Remember, your business credit score isn't just a number; it's a reflection of your company's overall financial health and trustworthiness. With a strong credit profile, you'll have access to the money you need, along with better terms and rates, and the ability to make strategic decisions for your company.

But don't wait. Because right now students with BRAND NEW companies are getting approved for $50,000-100,000 in no-doc business credit per lender! (We can help you do the same!)

We promise you'll be able to secure $50,000 or more in 6 months or less!

Does 6 months sound too long?

*Don't worry you'll probably secure business credit MUCH FASTER than 6 months but we like to under-promise and over deliver since some students are starting with no business whatsoever. If your business is already up and running this process will go MUCH FASTER for you and you can probably obtain $50,000+ in just a few weeks or even days!

One student recently got approved for over $100K in just 18 DAYS! Isn't that awesome?

Need more than $100K?

We've got you covered! This isn't just plain old vendor credit you heard about on social media. Not only will we show you how to find a virtually unlimited supply of lenders - we'll give you our business credit fast-track framework that will show you how your company can get approved for over $1,000,000 (over a million dollars) in no-doc unsecured business credit! Isn't that incredible?

If you're ready to take your business to new heights, then it's time to establish strong business credit with the help of Corporate Credit Secrets.

The Business Credit Guarantee You Won't Find Anywhere Else

Despite the "credit crunch" businesses (even brand new startups) are STILL getting approved for $50K, $100K, $150K every day! Aren't you ready to be one of them?

Imagine having access to over $50K-100K in credit within just a few weeks or months - it's not a dream, it's a guarantee. If you're not able to secure at least $50K within 12 months, we'll refund every penny!

You just need to know what lenders are looking for and the right steps to take.

With Corporate Credit Secrets, you can supercharge your business growth, expand your operations, and take your entrepreneurial journey to the next level. Don't miss out on the financial stability and competitive advantages that strong corporate and business credit can bring…

Corporate Credit Secrets is a step-by-step guide will show you exactly how to get approved for the best business credit offers to improve your company's cash flow and success. If your company needs more working capital - why wait? The methods we teach will work even in tight lending environments so there's no better time to learn how to get all the money your business needs.